jersey city nj tax collector

Our Association is comprised of over 1000 members for New Jerseys 565 municipalities. Webinar Information Presented By Speakers.

Township Of Teaneck New Jersey Tax Collector

ACH Direct Debit Application.

. 2020-2021 and prior year delinquent taxes. 65 years of age as of Dec. Click the below image for online payment.

Tax Collector City Treasurer. Online Inquiry Payment. City of Englewood New Jersey Web Site.

Eduardo CToloza CTA City Assessor. And other municipal charges through an on-. Left click on Records Search.

11 rows City of Jersey City. The Tax Collector Division is responsible for the preparation and sending of the real estate tax bills. Taxes paid after May 10 2022 will incur interest charges back to May 1 2022.

The Charter and applicable provisions of the Jersey City Code and exercise all the powers of a municipal assessor pursuant to law. Contactless online payment is preferredif you can please pay online. Monday through Friday 830 am to 430 pm.

Under Tax Records Search select Hudson County and Jersey City. Jersey City NJ 07302 Tel. Look up Property Assessments Tax Assessment Post Cards.

856-757-7003 7002 7004 7134 Email. 2800 or 3000 email us at krodriguestwpmaplewoodnjus. Among our ranks we have many of the states Tax Collectors Deputy.

Mailing Information All tax payments and correspondence should be mailed to. Annual Year Income Statement for qualifying Seniors PD 65. The City of Union City announces the sale of.

Webinars May 18-19 2021. Under the applicable statutes and New Jersey Constitution Fernandez said. To receive a receipt for payment please include the entire bill along with a self-addressed stamped envelope.

A listing of all parcels delinquencies and. Borough of Surf City 813 Long Beach Blvd Surf City NJ 08008. City Hall Municipal Offices 525 High Street Burlington NJ 08016.

The Tax Collectors office collects taxes sewer charges and curb and sidewalk special assessments. Instructions on How to Appeal Your Property Value. Tax Payment Due Dates August 1st November 1st February 1st and.

Find Jersey Online Property Taxes Info From 2022. City of Burlington Tax Assessor City Hall Municipal Offices 525 High Street Burlington NJ 08016. Line auction on June 22 2021 900 am.

All values are determined by inspection of the site in question and established per rules set forth by the State of New Jersey. Get more information on Lien Redemption and how you can put in a redemption request. Email Paul Lesniak.

If possible please utilize online payment options or use the dropbox located on the outside wall at the parking lot entrance to City Hall. Community Phone Numbers. City of Vineland Tax Collector.

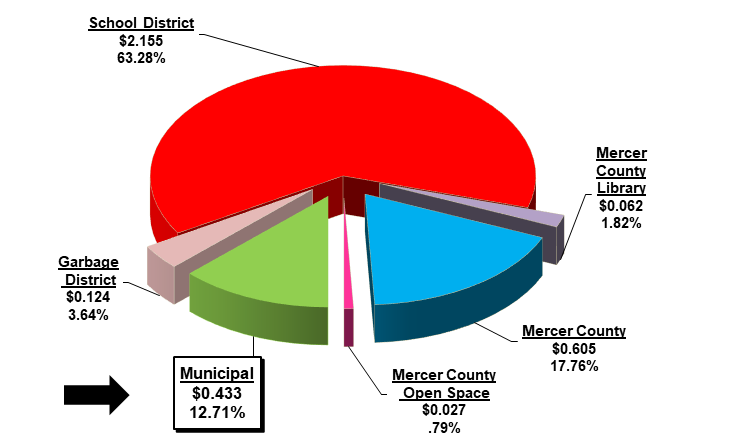

Send your check or money order to Plainfield Tax Collector 515 Watchung Avenue Plainfield NJ 07060. Costs along with bidding instructions please visit. This Division also has the responsibility of the receipt recording and depositing of all real estate tax payments made to the City the County the School Board Municipal Library and the Open Space Act.

31st the preceding year. The State of New Jersey does not. Devon Brown Email Devon Brown.

The Tax Collectors office is open to the public from 900 430 pm each business day. Tamara Beamer - Tax Collector. Sample Resolutions for Tax Office Use.

The Tax Assessors office works directly with the Atlantic County Board of Taxation. TO VIEW PROPERTY TAX ASSESSMENTS. ACH Direct Debits do not incur a fee.

Ad View County Assessor Records Online to Find the Property Taxes on Any Address. REQUEST FOR 200 PROPERTY OWNERS LIST Miscellaneous Payments. Taxcicamdennjus NJ Assessment Records Search.

Prepare the tax list and duplicate as required by law and maintain adequate assessment records of. For any additional questions please call us at 973 762-8120 ext. PO Box 228 Englewood NJ 07631 or 2-10 NVan Brunt Street Englewood NJ.

The City of Rahway 1 City Hall Plaza Rahway NJ 07065. Applications for the Senior Citizen Property Tax Deduction of 250 may be obtained 9am5pm MF from the office of. 51 rows Year Qtr Tr.

Summit NJ 07901. 7 hours agoThe average homeowner in Jersey City could see their municipal tax increase by over 1000. Ad Pay Your Taxes Bill Online with doxo.

The 105 transaction fee for paying with an e-check bank account and routing number will be credited back to your account to make it free. Under Search Criteria type in either property location owners name or block lot identifiers. Wingate CTC Tax Collector 862-227-5114 swingatehillsidenjus.

Department of Finance Bureau of Revenue Collections 520 Market Street City Hall Room 117 PO Box 95120 Camden NJ 08101-5120 Phone. Unless vaccinated masks are required for all persons entering City Hall. The Tax Assessors Office is responsible for the establishment and maintenance of real property values within the city.

Learn about paying your taxes in Elizabeth New Jersey. To qualify for the Deduction Applicant must be. No receipt will be sent unless a.

OFFICE HOURS Monday through Friday 900 am-430 pm. DLGS Taxation Work Calendar. Tax Collector 2nd Quarter Taxes are due May 1 2022.

Due Date Description Billed.

Camden Property Owners Get Rude Tax Awakening Whyy

Freehold Township Sample Tax Bill And Explanation

Applications And Forms City Of Jersey City

Is Jersey City Due For Another Reval Already A Taxpayer S Guide To The Issue Jersey City Times

Tax Collector S Office City Of Englewood Nj

Tax Assessor Paterson New Jersey

Official Website Of East Windsor Township New Jersey Tax Collector

Tax Finance Dept Sparta Township New Jersey

City Of Jersey City Online Payment System

The Official Website Of City Of Union City Nj Tax Department

Council Authorizes Mailing Of Higher Tax Bills To Homeowners

Jersey City Housing Authority Launches Low Cost Internet Program For Residents Hudson County View

Mayor S Office City Of Jersey City

Freehold Township Sample Tax Bill And Explanation